eKYC

Verify user identities via secure face recognition service.

99%+

Attack block rate

99%+

Recognition accuracy

100%

Reduced labor costs

eKYC Obtained

Global Certifications and Qualifications

eKYC Obtained

Global Certifications and Qualifications

BENEFITS

Why Choose Us

Leading Algorithms

Features cutting-edge facial recognition algorithms, which achieved an accuracy of 99.80% in the LFW evaluation conducted in 2017.

Leading Algorithms

Features cutting-edge facial recognition algorithms, which achieved an accuracy of 99.80% in the LFW evaluation conducted in 2017.

Security and Reliability

Powerfully defends against multiple non-living attacks including photos, videos and static 3D models, delivering consistent and trustworthy services.

Security and Reliability

Powerfully defends against multiple non-living attacks including photos, videos and static 3D models, delivering consistent and trustworthy services.

Easy Integration

Support diverse access options (SDK, API, H5) and flexible combination of product capabilities.

Easy Integration

Support diverse access options (SDK, API, H5) and flexible combination of product capabilities.

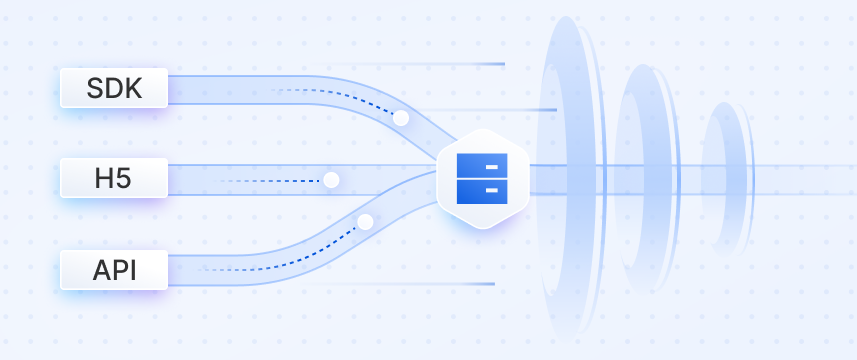

eKYC Introduction

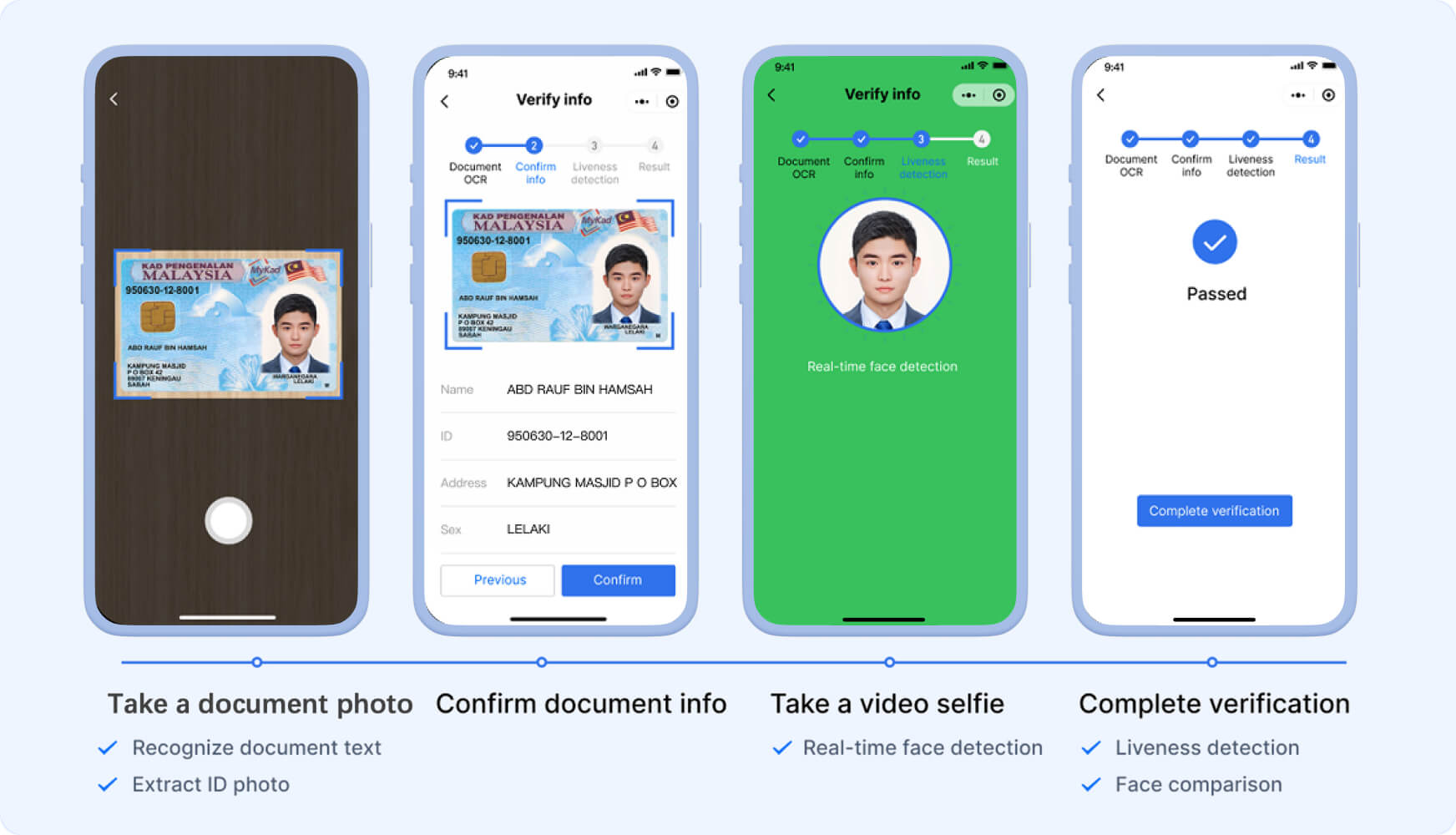

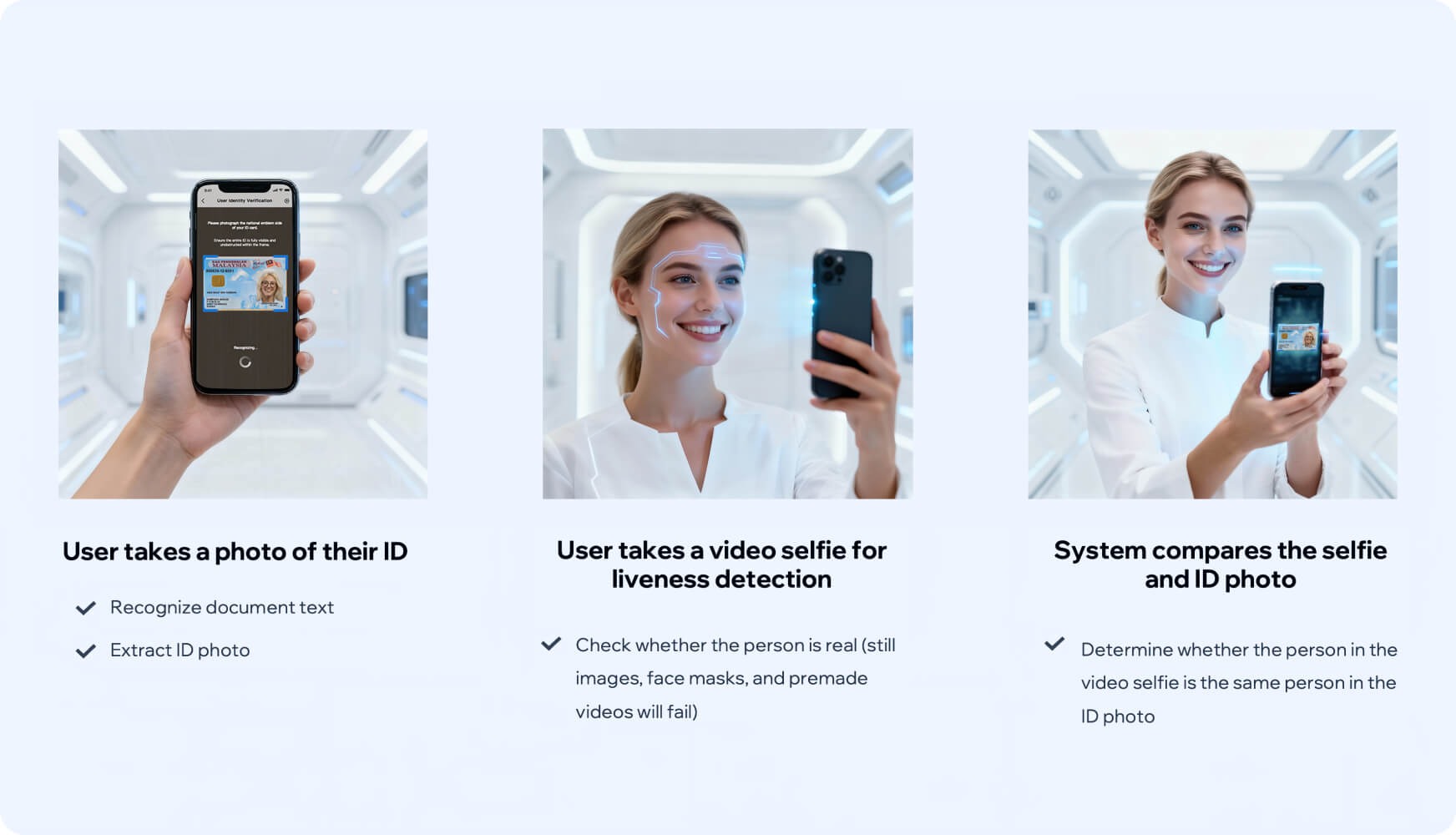

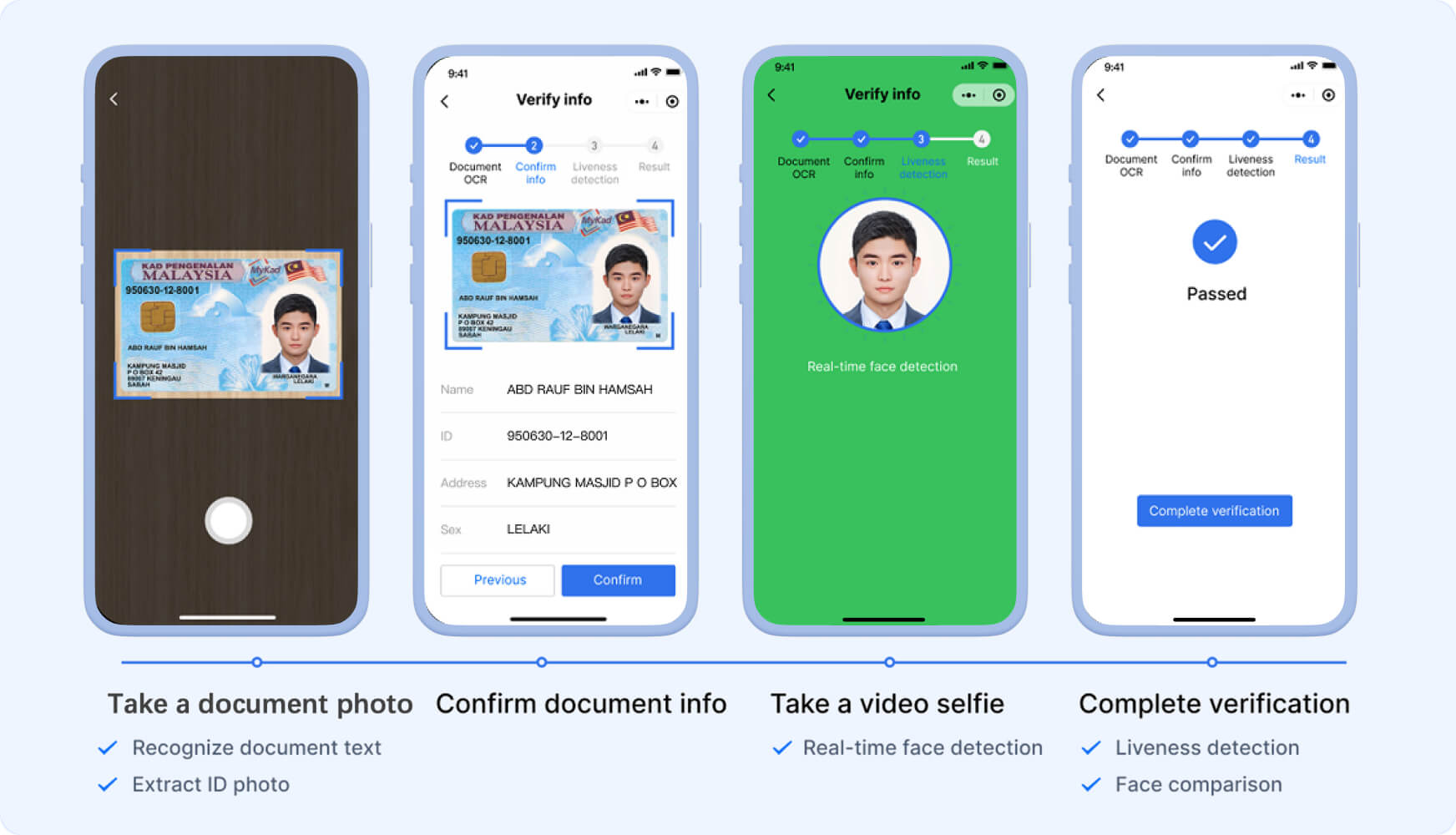

The Tencent Cloud eKYC solution uses Tencent's leading AI technologies of ID document recognition, liveness detection, and face comparison to simplify the complicated process of traditional identity verification into three automated steps. It accurately verifies the authenticity of user identities with AI algorithms.

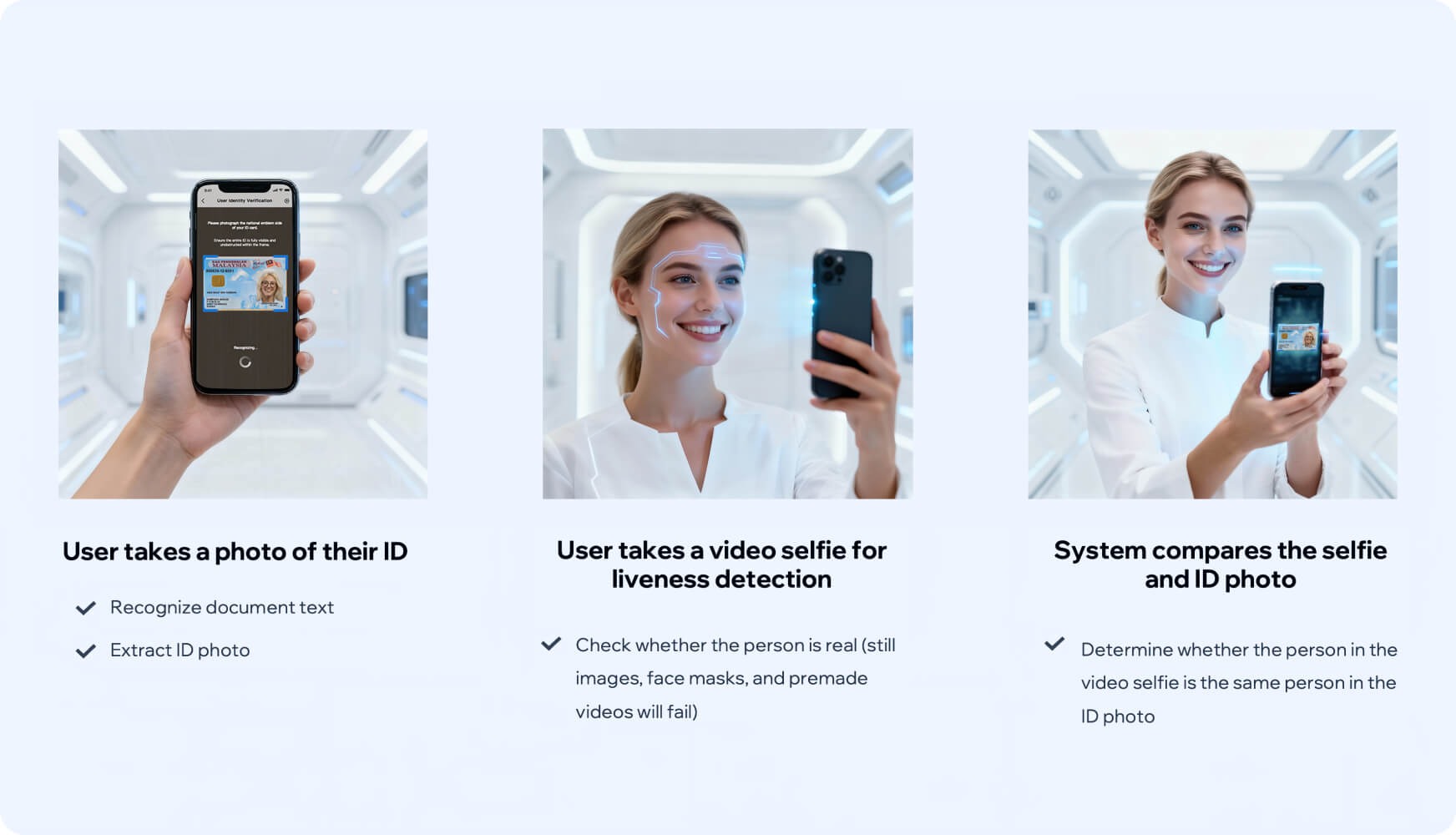

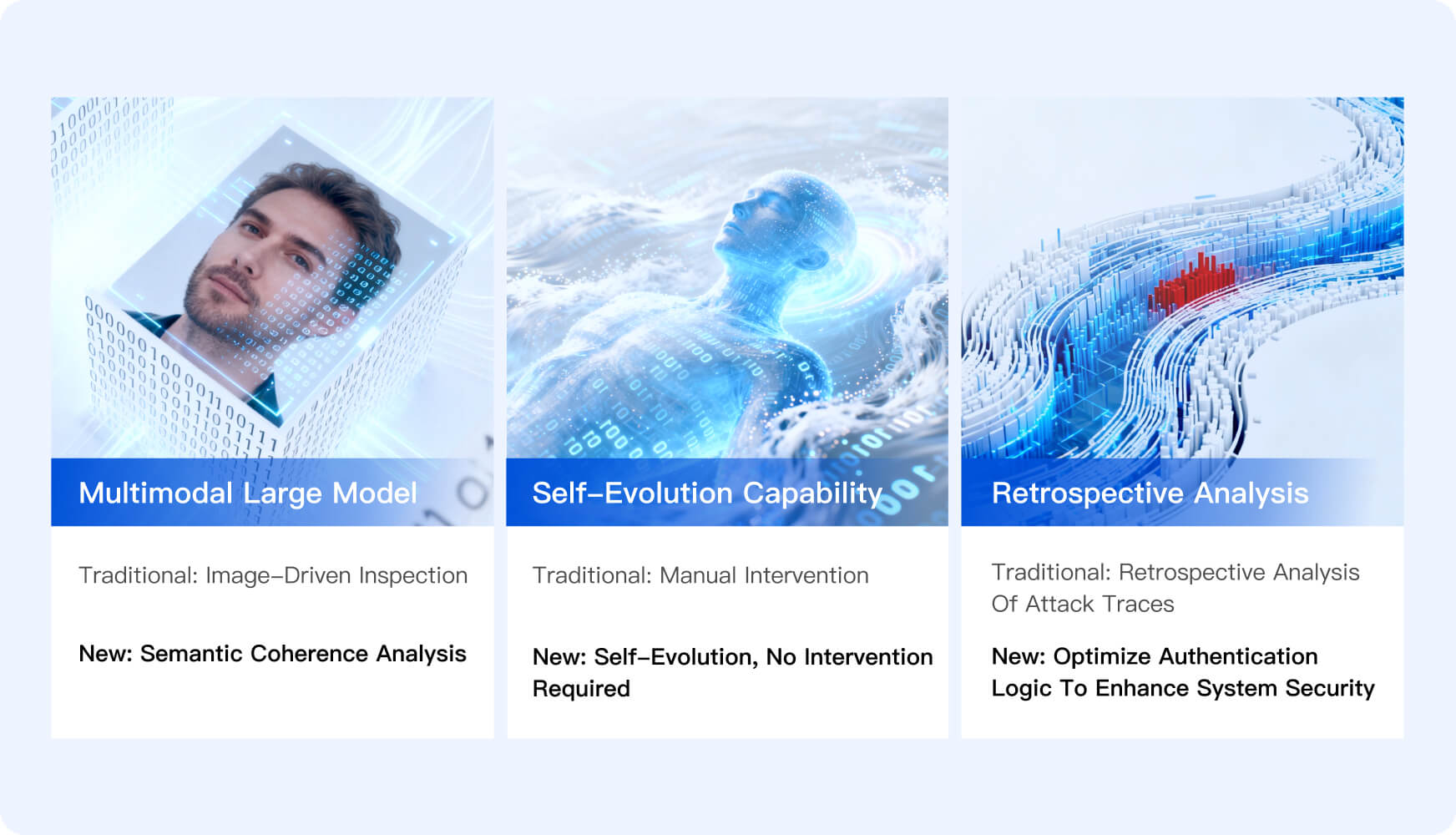

AI Face Shield

Powered by a multimodal foundation model integrated with semantic understanding and self-learning capabilities, this product specifically combats deepfakes and other AIGC attacks (e.g., AI face swapping, AI expression driving), continuously enhances defense mechanisms, and accurately combats organized fraud.

Interactive UI

Tencent Cloud eKYC can be easily integrated via app SDK, HTML5 or API. It can identify ID documents from multiple countries and regions, including Indonesia, Malaysia, Thailand, and Hong Kong (China),etc., providing efficient and accurate identity verification solutions to guarantee business security.

FEATURES

Discover the Key Features

eKYC Introduction

The Tencent Cloud eKYC solution uses Tencent's leading AI technologies of ID document recognition, liveness detection, and face comparison to simplify the complicated process of traditional identity verification into three automated steps. It accurately verifies the authenticity of user identities with AI algorithms.

AI Face Shield

Powered by a multimodal foundation model integrated with semantic understanding and self-learning capabilities, this product specifically combats deepfakes and other AIGC attacks (e.g., AI face swapping, AI expression driving), continuously enhances defense mechanisms, and accurately combats organized fraud.

Interactive UI

Tencent Cloud eKYC can be easily integrated via app SDK, HTML5 or API. It can identify ID documents from multiple countries and regions, including Indonesia, Malaysia, Thailand, and Hong Kong (China),etc., providing efficient and accurate identity verification solutions to guarantee business security.

SCENARIO

Variety of Solutions for Your Needs

Typical scenarios: Bank account opening, insurance verification, etc.

ID card recognition can be used in industries such as banking and securities where customer identity must be verified for remote account opening and money transfer. It helps banks reduce labor costs and improve customer experience. In the case where commercial insurance companies are unable to confirm the identity of the insured as he or she cannot be present due to illness, age, or other factors, eKYC offers remote face verification services to help prevent insurance fraud and other risks.

Typical scenarios: E-Wallet Payments

eKYC can verify the authenticity of user identities when users apply for an e-wallet for online remittance, bill payment, bank transfer, or other financial services, mitigating the security issues caused by identity fraud.

Typical scenarios:Social Media and Live Streaming

eKYC enables identity authentication for social networking, online live streaming, and other social media platforms that require real-name verification. Online real-name authentication effectively verifies user identities and reduces the cost of registering and reviewing user information.

Typical scenarios: SIM card registration, activation, etc.

Carriers can use eKYC to provide remote identity verification to customers registering for online services. The customers can self-serve online once verified.

STEPS

Steps for eKYC

1

Learn about Tencent Cloud eKYC

3

COMPLIANCE

Certifications and Qualifications

ISO/IEC 27001

ISO 27018

CSA STAR

ISO 27017

ISO 9001

ISO 20000

NIST CSF

PCI DSS

ISO 30107-3