Customer Introduction

Launched in August 2025 in Malaysia, Ryt Bank is The World’s First AI-powered bank designed for payment transfers using language-centric AI. Instead of relying on rigid, multi-screen workflows, Ryt bank enables customers to perform secure, real-time payment transfers through natural language and image-based conversations.

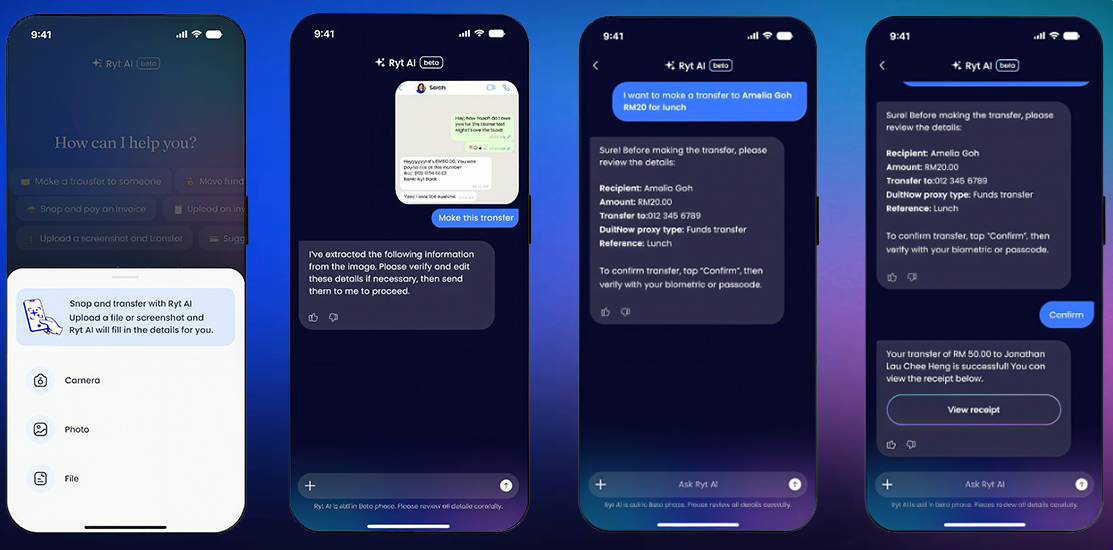

Powered by Ryt AI, customers can initiate everyday transactions—such as sending money or paying bills—through a conversational chat interface, reducing complexity while improving speed and clarity. Built to meet the rigorous standards of financial regulation, Ryt Bank applies AI selectively to mission-critical payment journeys, ensuring transparency, explainability, and user control.

Licensed and regulated by Bank Negara Malaysia, Ryt Bank demonstrates how conversational AI can be responsibly deployed in banking—balancing innovation with safety, trust, and compliance in real-world financial operations.

Pay with a snap | Pay with a text

Check your spending instantly | Move money seamlessly

Challenge & Goals

Ryt bank was established to reimagine how modern digital banking should work in a world where financial services are expected to be fast, intuitive, and always available. The goal was to reduce unnecessary complexity in everyday banking interactions, while maintaining the levels of security, reliability, and compliance required of a regulated financial institution.

To achieve this, Ryt bank re-examined the traditional reliance on button-driven, multi-screen user interfaces and explored alternative ways for customers to interact with banking services. This led to the adoption of a conversational, chat-based interface as the primary interaction layer—allowing users to communicate intent using natural language and images within a single, continuous flow.

However, redesigning core banking interactions around a conversational interface introduced a new set of mission-critical technical challenges, particularly when applied to regulated and time-sensitive banking workflows.

Mission-Critical Reliability

When a conversational interface is used as a primary interaction layer, the messaging system becomes a core banking component rather than a supplementary feature. Any dropped, delayed, or misrouted message can directly impact downstream banking actions, making reliable message delivery essential for operational stability.

Low Latency for Real-Time Execution

Many banking interactions are time-sensitive and require immediate system feedback. To support conversational interaction in these scenarios, the communication layer must operate with low latency and near-instant responsiveness to ensure accurate execution and sustained user confidence.

Security and Regulatory Compliance

As a regulated digital bank, conversational interactions must be treated as financial records. The underlying infrastructure therefore needs to meet enterprise-grade security and compliance requirements, support auditability, and operate reliably at scale—handling more than 140,000 monthly transactional interactions without service disruption.

Why Tencent Cloud

Ryt Bank developed its own proprietary AI engine (hallucination rates below 1.5% overall, <0.5% for high stakes flows, and guardrail effectiveness), but they needed a world-class communication pipe to deliver those AI capabilities to users. They chose Tencent Cloud Chat(IM) to power their messaging backbone for several key reasons:

- Ultra-Stable Global Channel: Tencent Cloud Chat(IM) is built on the same messaging technology that powers Tencent’s ecosystem, serving over 1 billion monthly active users and processing more than 550 billion messages per day at peak.

- Seamless AI Integration: The flexible APIs allowed Ryt Bank to plug their multi-layered AI Agents directly into the message flow, enabling the AI to "listen," "verify," and "execute" in real-time.

- Scalability: With 50,000 active users from day one, Ryt Bank required a partner that could scale instantly without performance degradation.

Highlighted Benefits

By offloading the complex messaging infrastructure to Tencent Cloud, Ryt Bank successfully launched a revolutionary banking model:

Zero-UI Efficiency: A traditional 8-step transfer process (login, select account, input amount, etc.) is now reduced to a single sentence: "Send $100 to Amelia."

- Enhanced Security: Every transaction is securely processed through Tencent RTC's global messaging channel, which offers stable and reliable communication infrastructure. Tencent RTC ensures that the transaction process is safe and seamless, surpassing traditional banking standards.

High-Velocity Growth: In just 4 months since launch, RYT Bank has attracted nearly one million downloads, with 60% of customers engaging with its core innovation, RYT AI.